Contents

- 1 The Importance of Operational Excellence in Insurance

- 2 Key Components of Operational Excellence in Insurance

- 3 Strategies for Achieving Operational Excellence in Insurance

- 4 Frequently Asked Questions (FAQs)

- 4.0.1 Q1: How can insurance companies enhance operational efficiency?

- 4.0.2 Q2: What role does data analytics play in achieving operational excellence in insurance?

- 4.0.3 Q3: How can insurers foster a culture of innovation and adaptability?

- 4.0.4 Q4: What are some key challenges in achieving operational excellence in insurance?

- 4.0.5 Q5: Can operational excellence improve customer satisfaction in insurance?

- 4.0.6 Q6: How can insurance companies ensure regulatory compliance while pursuing operational excellence?

- 5 Conclusion

- 6 Newsletter Signup Form

Introduction

The insurance industry plays a critical role in providing financial protection and risk management solutions to individuals and businesses. In an increasingly competitive landscape, insurance companies are constantly seeking ways to improve their operations and deliver exceptional value to their customers. This article explores the concept of operational excellence in the insurance industry, highlighting its importance, key components, and strategies for achieving it.

Understanding Operational Excellence in Insurance

Operational excellence is the relentless pursuit of efficiency, effectiveness, and continuous improvement throughout an organization’s operations. It involves streamlining processes, enhancing customer experience, optimizing resource allocation, and driving innovation to deliver superior outcomes. By achieving operational excellence, insurance companies can gain a competitive edge, reduce costs, and provide enhanced services to policyholders.

The Importance of Operational Excellence in Insurance

Enhanced Customer Experience: Operational excellence enables insurance companies to deliver seamless and personalized experiences to their customers. By optimizing processes and leveraging technology, insurers can provide faster response times, streamlined claims handling, and proactive communication, resulting in higher customer satisfaction and loyalty.

Cost Optimization: Operational excellence focuses on eliminating waste, reducing inefficiencies, and optimizing resource allocation. By streamlining operations, insurance companies can minimize costs, improve profitability, and allocate resources to value-adding activities that drive business growth.

Risk Mitigation: Operational excellence involves implementing robust risk management practices, ensuring compliance with regulatory requirements, and enhancing cybersecurity measures. By effectively managing risks, insurers can safeguard their operations, protect customer data, and maintain regulatory compliance.

Innovation and Adaptability: Operational excellence fosters a culture of innovation, encouraging insurance companies to embrace emerging technologies, explore new business models, and adapt to changing market dynamics. By staying agile and proactive, insurers can seize opportunities, enhance product offerings, and stay ahead of the competition.

Key Components of Operational Excellence in Insurance

Process Optimization: Insurance companies should analyze and streamline their core processes, identifying areas for improvement and implementing best practices. Process automation, digitization, and workflow management systems can enhance efficiency, reduce errors, and accelerate service delivery.

Data Analytics: Leveraging advanced analytics and business intelligence tools, insurers can gain valuable insights from their vast data repositories. By harnessing data, insurers can make informed decisions, identify trends, mitigate risks, personalize offerings, and enhance underwriting and claims processes.

Technology Enablement: Embracing technological advancements such as artificial intelligence, machine learning, and robotic process automation can revolutionize insurance operations. These technologies can automate routine tasks, improve accuracy, enhance fraud detection, and enable predictive modeling for risk assessment.

Employee Engagement and Training: Operational excellence requires a skilled and motivated workforce. Insurance companies should invest in employee training and development programs to equip their staff with the necessary knowledge and skills. Engaging employees in process improvement initiatives and fostering a culture of continuous learning can drive innovation and operational excellence.

Strategies for Achieving Operational Excellence in Insurance

Continuous Process Improvement: Implement a systematic approach such as Six Sigma or Lean methodologies to identify and eliminate process inefficiencies, reduce errors, and enhance productivity. Regularly assess performance metrics, gather feedback, and implement process improvements based on data-driven insights.

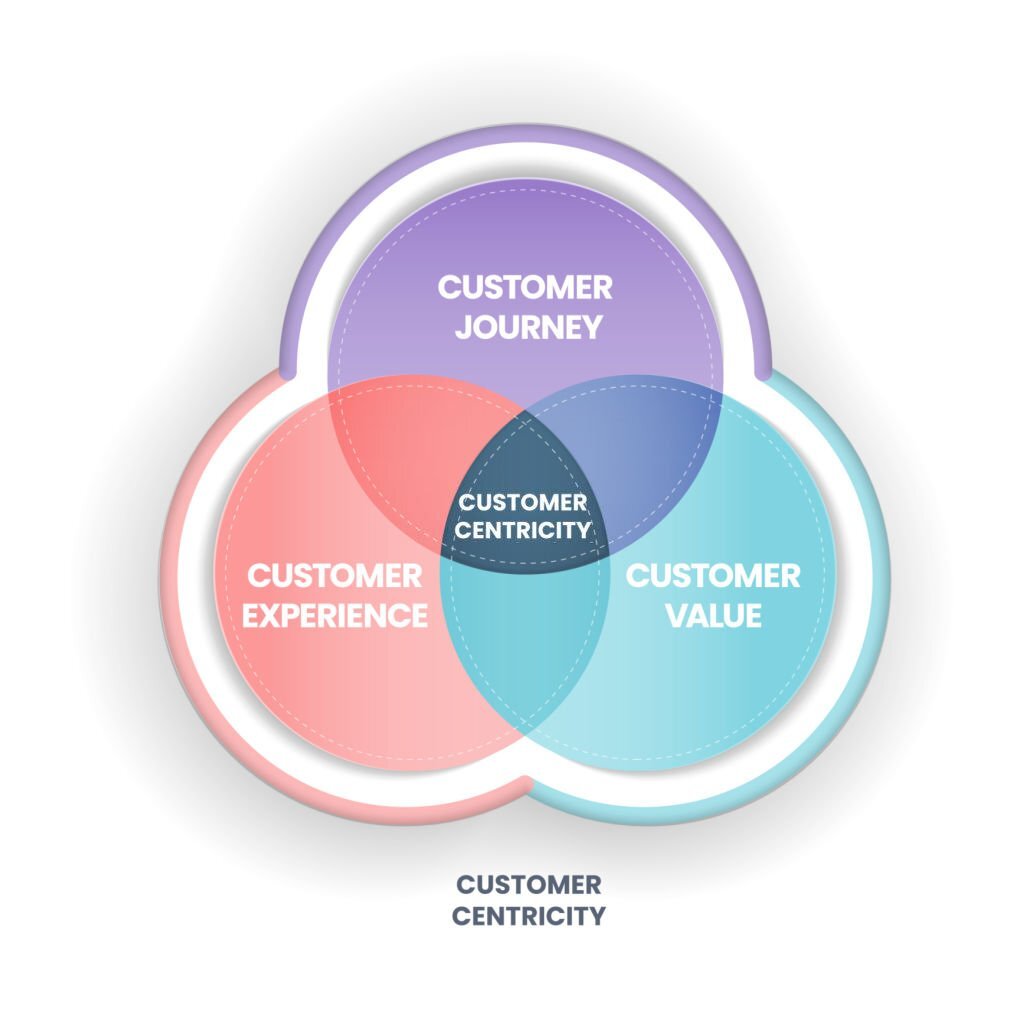

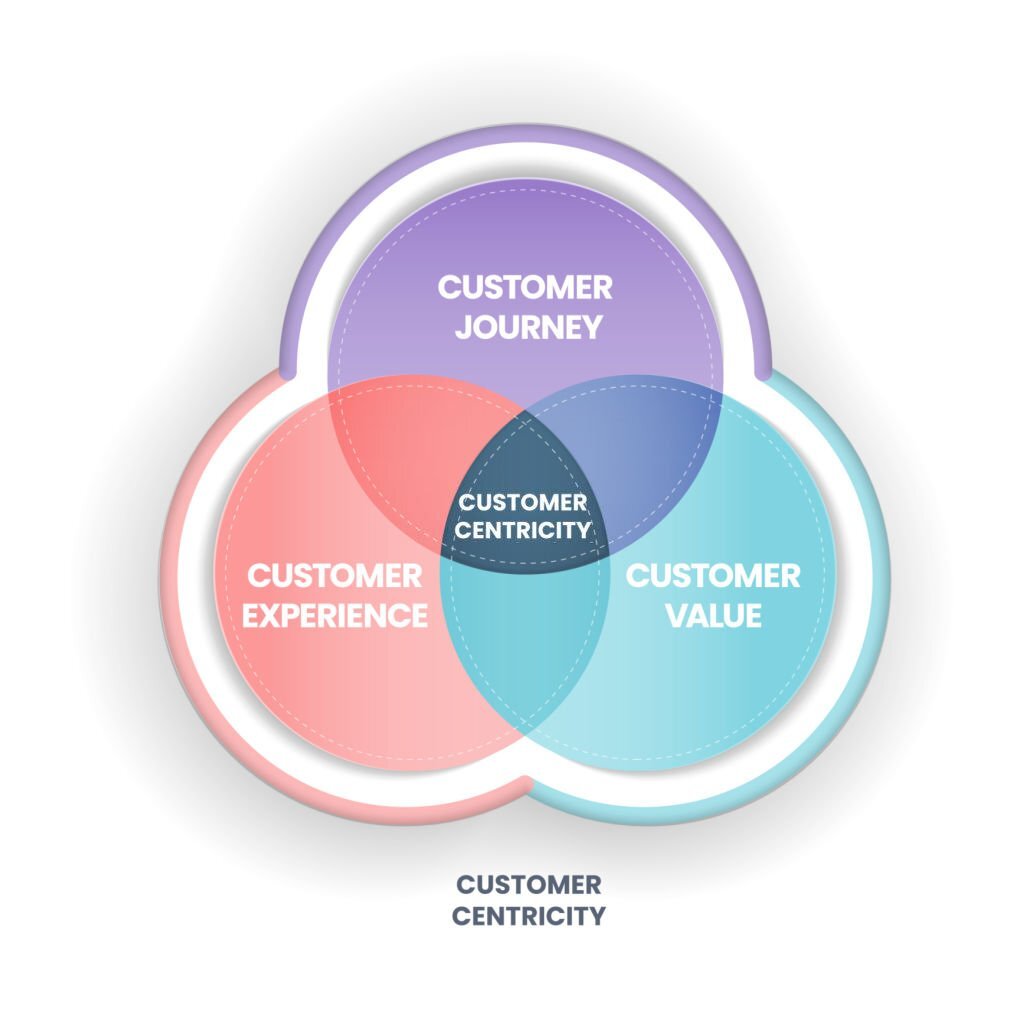

Customer-Centricity: Place the customer at the center of operations.

Understand customer needs, expectations, and pain points. Leverage customer feedback and insights to drive process improvements, develop tailored products, and deliver exceptional experiences throughout the customer journey.

Collaboration and Partnerships: Foster collaboration with technology partners, insurance tech startups, and other industry players. Collaborative initiatives can drive innovation, accelerate digital transformation, and create synergies that result in operational excellence.

Agile Project Management: Adopt agile project management methodologies to enhance project execution and improve time-to-market for new initiatives. Agile practices enable quick adaptation to changing market demands, ensuring the organization remains responsive and competitive.

Frequently Asked Questions (FAQs)

Q1: How can insurance companies enhance operational efficiency?

Insurance companies can enhance operational efficiency by streamlining processes, leveraging technology, optimizing resource allocation, and embracing continuous improvement initiatives such as Lean or Six Sigma methodologies.

Q2: What role does data analytics play in achieving operational excellence in insurance?

Data analytics plays a crucial role in achieving operational excellence in insurance. It enables insurers to gain insights from data, make informed decisions, personalize offerings, improve underwriting and claims processes, and enhance risk assessment and mitigation strategies.

Q3: How can insurers foster a culture of innovation and adaptability?

Insurers can foster a culture of innovation and adaptability by encouraging employee creativity, embracing emerging technologies, collaborating with insurance tech startups, and staying agile and responsive to changing market dynamics.

Q4: What are some key challenges in achieving operational excellence in insurance?

Some key challenges in achieving operational excellence in insurance include legacy systems and processes, resistance to change, data silos, talent shortage, and cybersecurity risks. Overcoming these challenges requires strategic planning, executive buy-in, and a holistic approach to transformation.

Q5: Can operational excellence improve customer satisfaction in insurance?

Yes, operational excellence can significantly improve customer satisfaction in insurance. By streamlining processes, reducing response times, delivering personalized experiences, and proactively addressing customer needs, insurers can enhance customer satisfaction and loyalty.

Q6: How can insurance companies ensure regulatory compliance while pursuing operational excellence?

Insurance companies can ensure regulatory compliance by implementing robust risk management practices, adhering to data protection regulations, conducting regular audits, and staying up-to-date with industry standards and regulatory requirements.

Read on

Conclusion

Operational excellence is a key driver of success in the insurance industry. By focusing on efficiency, effectiveness, and continuous improvement, insurance companies can enhance customer experiences, optimize costs, mitigate risks, and foster innovation. Embracing process optimization, data analytics, technology enablement, and employee engagement are essential components of achieving operational excellence. By unlocking operational excellence, insurance companies can position themselves as industry leaders, delivering superior value to their customers and stakeholders.

We have a firm belief that every organization has a unique purpose only they can fulfil in this world. We work with you in organizing your resources to exploit opportunities so that you can fulfil your purpose and realize full potential. We build the capacity of people, processes and systems for organizational success and growth as well as nurturing a thriving ecosystem.

Ready to enhance your skills and boost your career? Explore our corporate training programs now and start your journey to success.

Comment here